MINNEAPOLIS — In a sudden shift from the “maximum pressure” rhetoric that has defined Operation Metro Surge, President Trump’s newly deployed “border tsar,” Tom Homan, offered a conditional olive branch to Minnesota officials on Thursday: federal agents will begin a withdrawal from city streets, but only if local jails reopen their doors to federal immigration detainers.

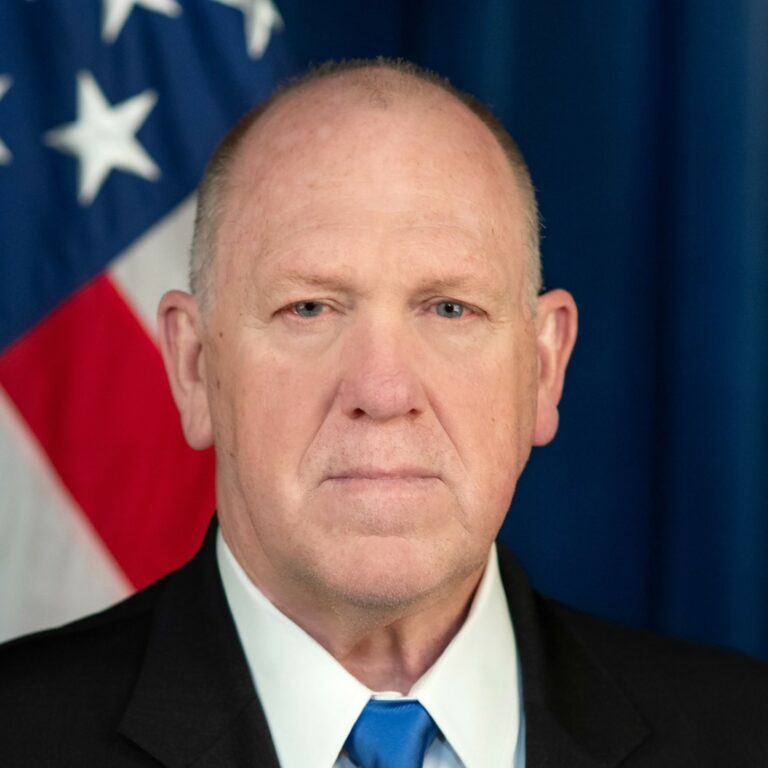

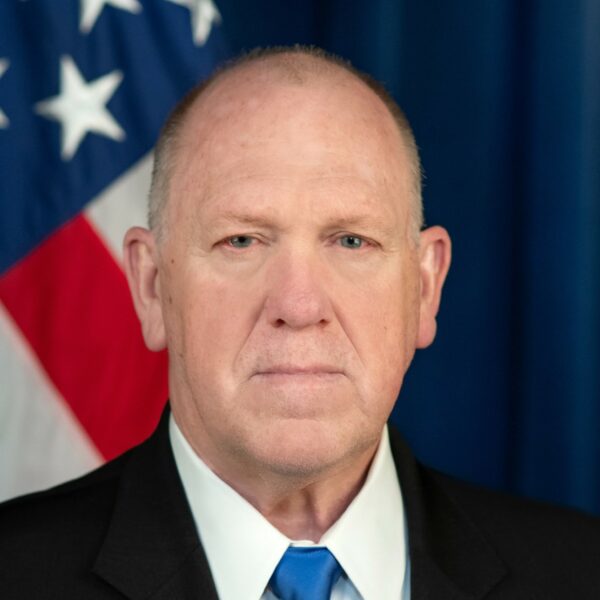

Standing before a bank of microphones for his first press conference since arriving in the Twin Cities, Homan—a veteran law enforcement officer known for his hardline stance—presented himself as a “fixer” sent by the President to clean up a mission that has spiraled into bloodshed.

“The withdrawal of law enforcement resources here is dependent upon cooperation,” Homan said. “Give us access to illegal aliens and public safety threats in the safety and security of a jail, and you won’t need thousands of agents on your street corners.”

The ‘Bovino Era’ Ends in Bloodshed

The deployment of Homan marks a strategic demotion for Gregory Bovino, the Border Patrol commander whose “Napoleon-like” leadership and aggressive street tactics were blamed for the deaths of two U.S. citizens—Renee Good and Alex Pretti—this month.

While Homan was careful not to explicitly condemn his predecessor, his remarks were a thinly veiled critique of the chaos that has engulfed South Minneapolis.

“I’m not here because the federal government has carried out this mission perfectly,” Homan conceded. “President Trump wants this fixed, and I’m going to fix it. We’re going to do it smarter, and we’re going to do it by the book.”

The Bargain: Jails for Streets

Homan’s proposal is a direct challenge to Minnesota’s “sanctuary” policies. Under the proposed “drawdown” plan:

- The Carrot: Federal tactical units would be redeployed away from residential neighborhoods and commercial corridors like “Eat Street.”

- The Stick: County jails must notify ICE of release dates for “public safety risks” and allow federal agents access to interview detainees.

- The Targeted Shift: Homan signaled a move away from indiscriminate street stops toward “targeted strategic enforcement,” focusing on what he called the “worst of the worst.”

Homan claimed that Attorney General Keith Ellison had already signaled some willingness to discuss release notifications for high-level threats—a potential crack in the unified front of Minnesota’s Democratic leadership.

A ‘National Shutdown’ Looms

Despite Homan’s pragmatic tone, the atmosphere in Minneapolis remains electric. Protesters, fueled by the viral footage of Alex Pretti’s final moments, have ignored the subzero temperatures to maintain a 24-hour vigil outside the Whipple Federal Building.

The Tensions on the Ground:

- Judicial Rebuke: On Wednesday, a chief federal judge condemned ICE for violating nearly 100 court orders during the operation.

- National Shutdown: Activists have called for a nationwide strike this Friday to demand the total expulsion of federal agents from the state.

- Local Resistance: Mayor Jacob Frey, while meeting with Homan, reiterated that the city’s resources would not be used to “tear families apart.”

| Key Player | Status | Stance |

| Tom Homan | Border Tsar | “Seek solutions” through jail access; will not “surrender the mission.” |

| Tim Walz | MN Governor | Met with Homan; agreed on the need for “ongoing dialogue.” |

| Keith Ellison | MN Attorney General | Litigating to end the surge while discussing public safety release alerts. |

| Jacob Frey | Minneapolis Mayor | Demanding an immediate end to “masked, heavily armed” street patrols. |

The Homan Doctrine

By sending Homan, Trump is betting that a “tough but fair” veteran can achieve the administration’s deportation goals without the PR disaster of more dead American citizens. Homan’s “Jailhouse Pivot” is a gamble that local leaders, exhausted by the civil unrest and the financial strain of the “siege,” will trade their sanctuary principles for a return to normalcy.

As the first units of federal agents were seen packing gear into transport vans late Thursday, the question remains: is this the beginning of the end of the Minneapolis crackdown, or merely the start of a more invisible, institutionalized phase of the surge?