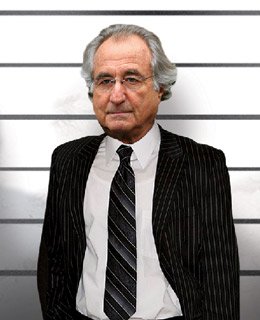

Bernie Madoff Dies in Prison Aged 82

Disgraced Wall Street financier Bernie Madoff has died in prison at age 82.

Bernie Madoff admitted to one of the biggest frauds in US financial history.

His death was announced by the Bureau of Prisons.

Bernie Madoff had been serving a 150-year sentence after he pleaded guilty in 2009 to running a Ponzi scheme, which paid investors with money from new clients rather than actual profits.

It collapsed during the 2008 financial crisis.

Bernie Madoff,the son of European immigrants who grew up in New York, set up his eponymous firm Bernard L. Madoff Investment Securities in 1960.

The company became one of the largest market-makers – matching buyers and sellers of stocks – and Bernie Madoff served as chairman of the NASDAQ stock exchange.

His company was investigated eight times by the Securities and Exchange Commission because it made exceptional returns.

But it was the global recession which effectively prompted Bernie Madoff’s demise as investors, hit by the downturn, tried to withdraw about $7 billion from his funds and he could not find the money to cover it.

He confessed the problem to his sons, who went to the authorities.

The list of those scammed included actor Kevin Bacon, Hall of Fame baseball player Sandy Koufax and film director Steven Spielberg’s charitable foundation, Wunderkinder.

UK banks were also among those who lost money, with HSBC Holdings saying it had exposure of around $1 billion. Other corporate victims were Royal Bank of Scotland and Man Group and Japan’s Nomura Holdings.

But it was not just the elite and large firms who were victims of the fraud.

School teachers, farmers, mechanics and many others also lost money.

“We thought he was God. We trusted everything in his hands,” Nobel Peace Prize winner Elie Wiesel, whose foundation lost $15.2 million, said in 2009.

Bernard Madoff hospitalized after suffering heart attack in prison

JPMorgan Chase agrees to pay $1.7 billion to victims of Bernard Madoff fraud

Andrew Madoff was under investigation until he died

In court, Bernie Madoff said that when he started the scheme in the 1990s, he hoped it would only be for a limited time.

The scam involved an estimated $65 billion, a figure that included gains Bernie Madoff’s clients believed they had made due to fake account statements.

Of the more than $17 billion in cash losses, more than $14 billion has been recovered.

In 2020, Bernie Madoff requested early release from prison citing health problems, including kidney disease. In an interview with The Washington Post he said he had “made a terrible mistake.”

“I’m terminally ill,” he said.

“There’s no cure for my type of disease. So, you know, I’ve served. I’ve served 11 years already, and, quite frankly, I’ve suffered through it.”

Judge Denny Chin denied Bernie Madoff’s request, noting many victims were still suffering due to their financial losses.

“I also believe that Mr. Madoff was never truly remorseful, and that he was only sorry that his life as he knew it was collapsing around him,” the judge wrote.

At least two investors with Bernie Madoff committed suicide after their losses. His son Mark also killed himself on the second anniversary of his father’s arrest. His other son, Andrew, died of cancer in 2014.

Bernie Madoff is survived by his wife, Ruth Madoff, who maintained she was unaware of the scheme and was never charged. Prosecutors let her keep $2.5 milllion from the $825 million fortune the couple once possessed.