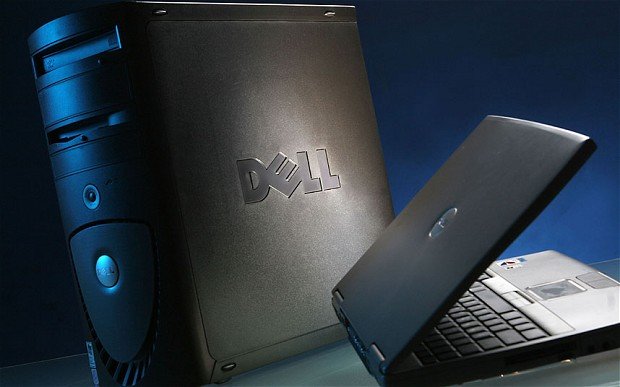

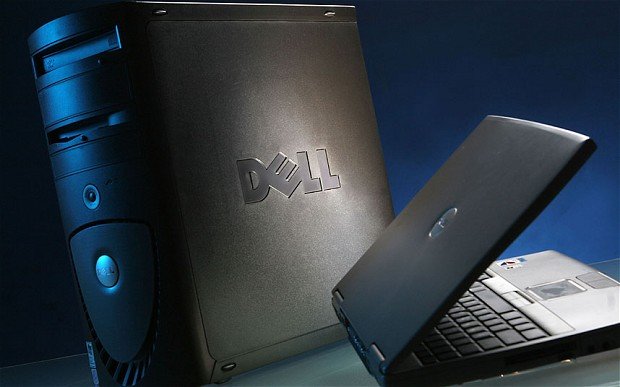

Dell has reported a 79% slide in net profit, underlining a fall in personal computers sales as more consumers shift to smartphones and tablets.

The PC maker’s net profit fell to $130 million in the three months to May 3, on revenue down 2% to $14 billion.

Dell is in the middle of a dispute between founder Michael Dell and two of its biggest shareholders.

Michael Dell wants to take the company private, but some investors oppose the plan.

Michael Dell and private equity group Silver Lake have offered to buy back the company for $24.4 billion, and have pledged to shift the business away from PCs to mobile devices.

But its biggest shareholders – the investor Carl Icahn and Southeastern Asset Management – have argued that the valuation of the company is too cheap, and that Michael Dell’s deal is a “giveaway”.

Instead, they have proposed to offer additional shares to shareholders and install mew management.

In its quarterly results, Dell said that revenue from new technologies, services and software, rose 12% to $5.5 billion. That was in contrast to PC sales, which fell 9%.

Dell did not issue a profit guidance for the second quarter due to the ongoing dispute. The company has created a special committee of the board to study the private equity deal and alternative bids.