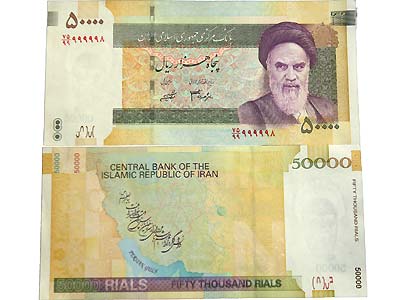

The rial, Iran’s beleaguered currency, has fallen to fresh record lows against the US dollar.

It fell a further 9% on Tuesday after Monday’s 18% decline, reports say.

Iran’s central bank has placed a $5,000 limit on the amount of foreign currency travellers can take in or out.

President Mahmoud Ahmadinejad has blamed “the enemies of his country” for the sharp falls. The rial has reportedly lost more than 80% of its value since 2011 because of US-led trade sanctions.

Mahmoud Ahmadinejad said Western sanctions amounted to an economic war, but would not stop Iran’s nuclear programme.

“We are not people to retreat on the nuclear issue,” he told a news conference in Tehran.

“If somebody thinks they can pressure Iran, they are certainly wrong and they must correct their behavior,” he said.

Recent moves by Tehran to ensure key importers can buy dollars at a cheaper rate is said to have worsened matters.

The US-led sanctions are being imposed on Iran because of the country’s disputed nuclear programme. The US accuses Iran of aiming to build nuclear weapons, while Iran counters that it simply wishes to develop nuclear power stations.

The sanctions, which are backed by the European Union, include a ban on the purchase of Iranian oil.

The US has also threatened to take action against foreign firms and institutions dealing with the Iranian central bank.

While Iranians are said to be scrambling to convert their rials into hard currency, thereby adding to the downward pressure on the rial, the government has blamed speculation by money changers.

According to the Iranian Fars news agency, Iran’s Minister of Industry, Mines and Trade, Mehdi Ghazanfari, said: “We have greater expectations that the security services will control the branches and sources of disruption in the exchange market.

“Brokers in the market are also pursuing the increase in price, because for them it will be profitable, and there is nobody to control them.”

On Tuesday, the rial was said to be trading in Iran at about 37,500 to the dollar, down from around 34,200 late on Monday.

The rial is not traded on the global currency markets, so it is not possible to produce accurate figures for its value.

The weakness of the rial has harmed the wider Iranian economy, as it means the country cannot afford to import as many foreign goods and raw materials which are priced in hard currencies.

As a result of the tightened trade sanctions, Iran’s income from oil exports had fallen by 45% this year, causing the shortage in dollars and other hard currencies.

He added that Iranian authorities had for many years used the country’s abundant oil earnings to keep the rial artificially high.

With oil revenues now sharply reduced, our reporter said that both the government and the central bank now seemed unsure how to react.

He added: “Iran’s years of state intervention in the artificial appreciation of the rial, thanks to abundant petro-dollars, has turned the currency into a barrel of gunpowder now detonated by sanctions.

“At a time of crisis, President Mahmoud Ahmadinejad’s government is plagued by inefficiency, mismanagement and a domestic power struggle.”