Italian bank Monte dei Paschi di Siena (MPS) – known as the world’s oldest surviving bank – has reported a bigger-than-expected loss.

MPS, which has been in business since 1472, reported a second quarter loss of 179 million euros, three times the loss analysts had been expecting.

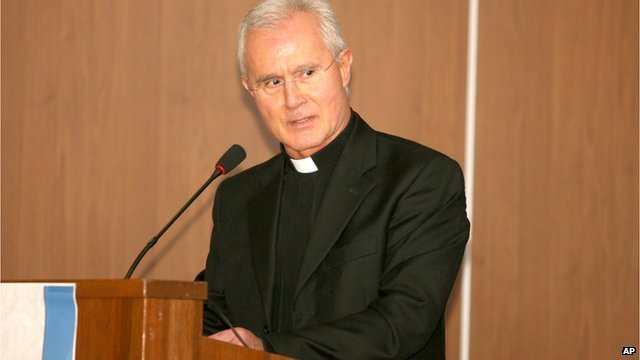

Monte dei Paschi di Siena is known as the world’s oldest surviving bank (photo Getty Images)

It was the bank’s ninth consecutive quarterly loss.

MPS, which was bailed out by the state last year, blamed the rising costs of bad loans.

The bank has been through some turbulent years since buying rival bank, Antonveneta for more than 10 billion euros at the height of the financial boom in 2007.

That deal stretched the finances of MPS and the subsequent global financial crisis almost caused the bank to collapse.

The Italian government had to step in and bailout the company.

In June, MPS raised 5 billion euros on the stock market which it used to pay back state aid and boost its financial situation.

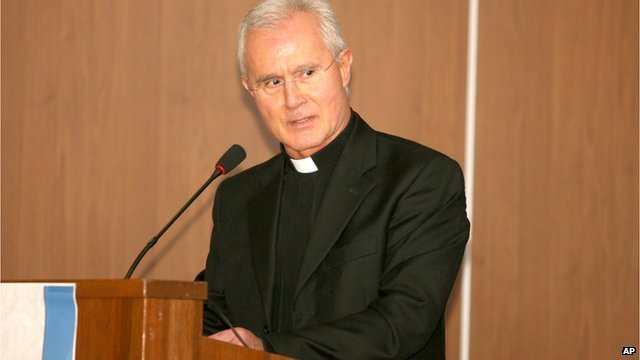

Monsignor Nunzio Scarano, a senior Italian cleric, has been arrested in connection with an inquiry into the Vatican bank scandal over allegations of corruption and fraud.

Monsignor Nunzio Scarano works in the Vatican’s financial administration. A secret service agent and a financial broker have also been arrested.

They are suspected of trying to move 20 million euros illegally into Italy.

Pope Francis ordered an unprecedented internal investigation into the bank’s affairs in the wake of recent scandals.

Monsignor Nunzio Scarano has been under investigation by Italian police for a series of suspicious transactions involving the recycling of a series of cheques described as church donations through the Vatican Bank.

Monsignor Nunzio Scarano has been arrested in connection with an inquiry into the Vatican bank scandal over allegations of corruption and fraud

Earlier this month, the pontiff named a trusted cleric to oversee the management of the bank, which has been beset by allegations of money-laundering.

Officially known as the Institute for the Works of Religion, the bank is one of the world’s most secretive. It has 114 employees and $7.1 billion (5.4 billion euros) of assets.

Pope Francis has given the commission carte blanche, bypassing normal secrecy rules, to try to get to the bottom of scandals which have plagued the bank for decades.

Traditionally, the Vatican Bank has refused to co-operate with Italian authorities investigating financial crime on the grounds of the sovereign independence of the Vatican city state.

But Pope Francis has shown that he is now determined to get to the bottom of long-standing allegations of corruption and money-laundering by the bank.

The Institute for the Works of Religion was a major shareholder in the Banco Ambrosiano, a big Italian bank which collapsed in 1982 with losses of more than $3 billion.

Its chairman, Roberto Calvi, was found hanging from Blackfriars Bridge in London – in a murder disguised as a suicide. Roberto Calvi had close relations with the Vatican.

Italian bank Unicredit has confirmed it is co-operating with a US investigation into a possible breach of sanctions.

The bank is thought to have broken sanctions against Iran, according to reports by the Financial Times and Reuters, although this has not been confirmed by Unicredit.

The probe centres on a German subsidiary, HypoVereinsbank, which the major Italian bank bought in 2005.

The news follows similar revelations about two UK banks.

Unicredit originally admitted in January as part of a regulatory filing that it was working with US authorities over a sanctions breach, but without naming the country involved.

“A member of the Unicredit group is currently responding to a third party witness subpoena from the New York County District Attorney’s Office in connection with an ongoing investigation regarding certain persons and/or entities believed to have engaged in sanctionable activities,” the January filing said.

Unicredit is thought to have broken sanctions against Iran, according to the Financial Times

According to Unicredit’s latest statement, which does not name Iran either, the investigation is also being conducted by the US Department of Justice.

Last month the US Senate released a report detailing how HSBC helped launder money for Iran, as well as for other US-sanctioned governments of Burma and North Korea and for Mexican drugs cartels.

Then, earlier this month, Standard Chartered Bank – which is headquartered in London, but mainly active in the Middle East, Africa and Asia – agreed to pay New York regulators $340 million to settle claims that it had concealed $250 billion in transactions with Iran.

Meanwhile, Royal Bank of Scotland is also understood to be facing investigations into whether it has broken sanctions against Iran.

The bank would not comment, but confirmed that it had voluntarily approached US and UK officials with information after an internal inquiry uncovered possible infringements.

Germany’s Commerzbank also warned last week that it may have to make a hefty payment to settle a US investigation into its own violations of sanctions on Iran and other countries.

Press reports earlier this month suggested that another German bank, Deutsche Bank, is also being investigated by the US Treasury’s Office of Foreign Assets Control, the Federal Reserve, the US Justice Department and Manhattan’s district attorney’s office for alleged infringements of US-Iran economic sanctions.

Deutsche Bank refused to comment on the reports.

Iran has been subject to US economic sanctions since 1979. The current system operates under the US Treasury Department’s Office of Foreign Assets Control.

The sanctions were toughened in 1997 by then-President Bill Clinton, who signed an order for sanctions that prohibited “virtually all trade and investment activities with Iran by US persons, wherever located”.

Under US criminal law, violations of the Iranian Transactions Regulations may result in a fine up to $1 million and/or jail for up to 20 years.

As part of the sanctions regime, until 2008, banks in the US in some circumstances were allowed to undertake so-called U-turn transactions with Iranian financial institutions.

Those U-turn transactions move money for Iranian clients among non-Iranian foreign banks, such as those in the UK and the Middle East. They are cleared through the US, but neither start nor end in Iran.

To ascertain whether these transactions are permitted, US clearing banks use the wire-transfer messages they get from banks, using the SWIFT payments system.

If the banks do not have enough information to make the call, they are supposed to freeze the assets.

The allegations involving Standard Chartered and HSBC both centred on U-turn transactions.

Standard Chartered was accused of stripping the messages of data that showed the clients were Iranian, replacing it with false entries.

The UK-based bank said that not only did “99.9% of the transactions” relating to Iran comply with U-turn regulations, but that the total value of transactions that did not comply was under $14 million – converse to the $250 billion worth of Iran transactions US regulators said it had hidden.

In July, a US Senate Committee found that HSBC carried out 25,000 transactions totalling $19 billion that were connected to Iran between 2001-07, which it suggested was evidence that the bank may have broken economic sanctions.