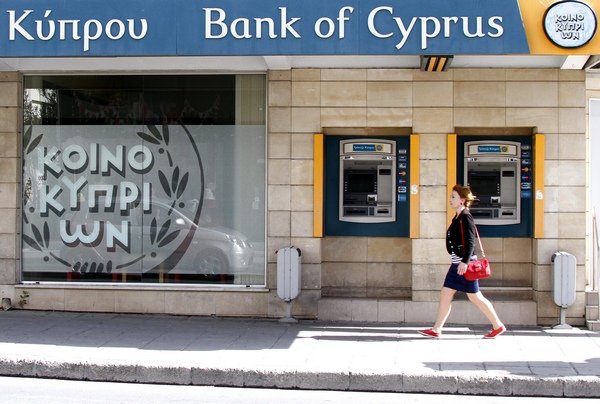

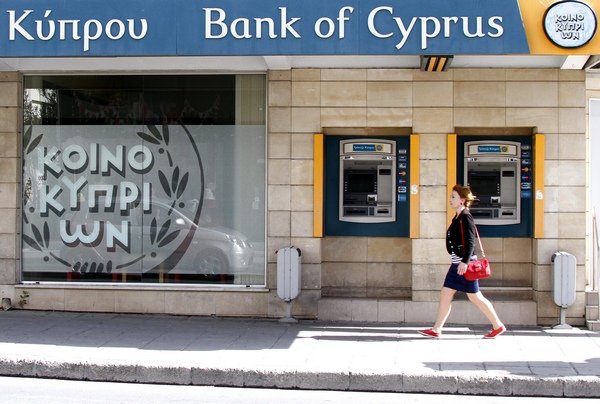

Investigators have found that some key data about bond purchases by Bank of Cyprus is missing.

According to Cypriot media, the gaps were found in computer records studied by a financial consultancy, Alvarez and Marsal.

Bank of Cyprus – the country’s biggest bank – bought Greek bonds which turned into some 1.9 billion euros ($2.4 billion) of losses in the Greek debt crisis.

Depositors with more than 100,000 euros in Bank of Cyprus are now facing a big loss.

The “haircut” for such deposits in the bank is expected to be about 60%.

Investigators have found that some key data about bond purchases by Bank of Cyprus is missing

The money taken from those accounts, and from deposits above 100,000 euros at Laiki (Popular) Bank, will be used by the Cypriot government to contribute billions towards the bailout.

Strict capital controls – unprecedented for the eurozone – are in force in Cyprus, limiting cash withdrawals to prevent a run on the banks.

The “haircut” – hugely unpopular in Cyprus – is a condition for the EU and IMF to grant a 10 billion-euro bailout to rescue the country’s economy.

The Cyprus Mail website says information provided by Bank of Cyprus was incomplete and data-deleting software was found on some computers there.

There were significant gaps in computer records for the period 2007-2010. It is not yet clear whether the wiping of records was accidental or deliberate. There were signs of mass deletion of data.

The central bank says that Alvarez and Marsal are now investigating Laiki too – the island’s second largest bank, which is being wound up and folded into Bank of Cyprus.

“The investigation will continue and cover: the purchase of Greek government bonds by Laiki Bank; the expansion of Laiki Bank outside Cyprus; the role and responsibilities of all parties involved,” the Central Bank of Cyprus said on Friday.

The consultancy’s report on Bank of Cyprus has been leaked to local media, but not yet published.

Besides the Greek bond purchases, the consultancy also scrutinized Bank of Cyprus operations in Romania and Russia.

The consultancy’s findings have been handed over to the Cypriot parliament and the attorney-general, Petros Clerides.

The government has appointed a special judicial panel to clarify what happened in Cyprus’ financial crash and pinpoint any wrongdoing.

Moody’s rating agency has cut Greece’s credit rating again, citing a risk of default despite a recent debt write-off deal.

Moody’s cut Greece’s rating from “Ca” to “C”, the lowest level on its scale.

The agency said on Friday: “Today’s rating decision was prompted by the recently announced debt exchange proposals for Greece, which imply expected losses to investors in excess of 70%.”

The deal writes off 107 billion Euros ($141.3 billion) of Greece’s debt.

Moody's rating agency has cut Greece's credit rating again, citing a risk of default despite a recent debt write-off deal

Moody’s said the planned debt exchange, which involves private investors of Greek debt writing off much of the 206 billion Euros in Greek bonds they hold, “would constitute a distressed exchange, and hence a default”.

The agency acknowledged that the deal was necessary to help stabilize Greece. But Moody’s said: “The risk of a default even after the debt exchange has been completed remains high. Moody’s believes that Greece will still face medium-term solvency challenges.

“The country is unlikely to be able to access the private market once the second assistance package runs out; and its planned fiscal and economic reforms will still face very significant implementation risks.”

Earlier this week the Standard & Poor’s agency classified Greek debt as in “selective default”.

Standard & Poor’s (S&P) has classified Greece as in “selective default” following the deal the country made with its creditors to reduce the debts.

S&P rating agency says the terms of that deal triggered the latest downgrade. Greek debt already had a “junk” grade rating from the agency.

Separately, the European Central Bank (ECB) said it was suspending the eligibility of Greek bonds as collateral for loans to commercial banks.

It said this would run until mid-March.

The ECB explained that by the middle of next month it would start to accept the bonds again, because a programme for eurozone nations to provide supplementary collateral to insure the ECB against losses is due to come into effect.

Banks and other financial firms are being asked by Greece’s government to take a 53.5% loss on their Greek sovereign bonds.

Austerity measures have prompted mass demonstrations in Greece

The plan was agreed by the Greek parliament last week, and, if backed by Greece’s creditors, it would wipe out 107 billion Euros ($142 billion) of the country’s debt.

S&P said that when the debt exchange was complete it would assess Greece again and possibly raise its rating.

The Greek government said S&P’s move had been expected and added it would not hurt the banking industry.

“This rating does not have any impact on the Greek banking system since any likely effect on liquidity has already been dealt with by the Bank of Greece,” the finance ministry said in a statement.

Last week, rival credit rating agency Fitch also downgraded Greece’s debt.