The US growth rate has been revised upwards for Q4 of 2015, according to the latest official figures.

The economy grew at an annualized pace of 1% in Q4, compared with an initial estimate of 0.7%.

Most economists had taken a more pessimistic view, expecting the figure would be revised downwards.

However, businesses bought more stock than previously estimated, which meant inventory levels were $13 billion higher.

The downside is that next month’s growth figures may be lower than expected if businesses do get round to cutting back on inventory spending.

Some forecasts put the growth rate for the first three months of 2016 as high as 2.5%.

Consumer spending, which accounts for more than two-thirds of US economic activity, rose at a 2% pace in Q4, rather than the 2.2% rate previously estimated.

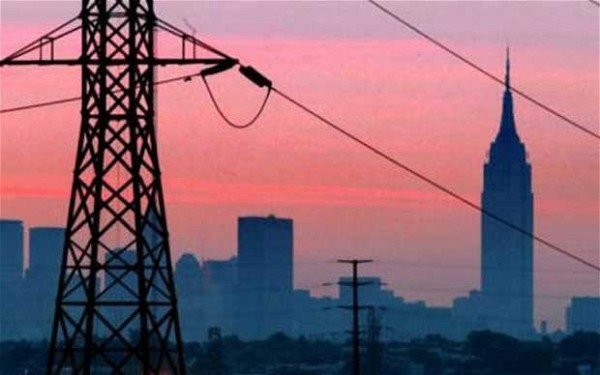

Cheap oil and lower heating bills from a mild winter has helped consumer confidence.

The chair of the Federal Reserve, Janet Yellen has indicated that rates could rise gradually through the year if the economy grows strongly enough.

However, many economists believe US growth will be held back by slowing economies round the world from China to Brazil, pushing down the prices of raw materials and leading to deflation.

A Reuters survey this month estimated that the top 30 global oil companies had cut their budgets by an average of 40%.