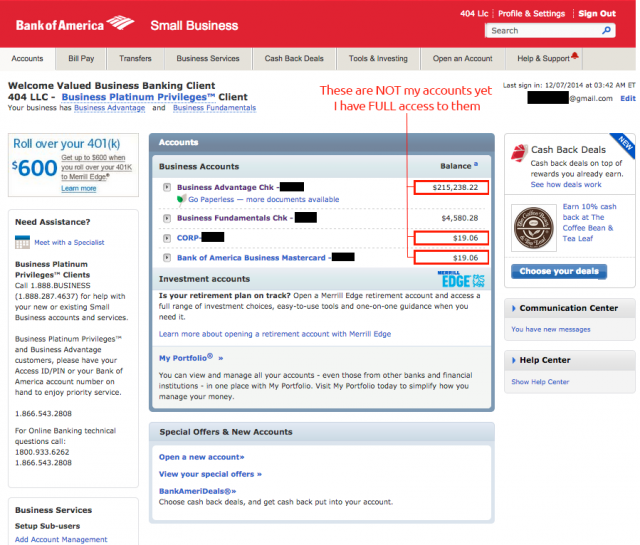

What would you do with a $215,238 Christmas present from Bank of America?

A Bank of America’s client claims that he got full access to someone else’s account because they had the same user name.

After the bank mistakenly granted him with $215,238.22, the California man says he decided to leave banks entirely for Bitcoin.

“This is the exposure of a fundamental problem of a bank not able to operate under the tenets of a bank,” he wrote in a post on reddit.com.

“I’ve moved everything out of the banking system but what is necessary to be able to operate conveniently in the fiat economy. After what just happened I realize I have to go full bitcoin,” he added.

The man then explained how Bank of America made him “almost a quarter million dollars” richer:

- I logged into Bank of America and immediately noticed that I had almost a quarter million dollars more than I did the day before. My account is there, and so are some other accounts.

- I looked through the transactional details of the unfamiliar account and online statements. It definitely wasn’t an old account of mine that someone had generously funded without telling me. This is someone else’s account and I have full access to it and all information associated with it. I do a test and get as close as I can to transferring money out it without clicking the final button. It’s obvious I can transfer money out of it.

- I realize that calling online banking support will put the issue in the hands of an attendant who views this as a technical problem that is solved by merely moving the accounts out of my login without realizing how fundamentally significant this is. Open ticket, close ticket, nothing to see here.

- I drive to the local branch and request the manager. I tell him that if he has a few moments I have something interesting to show him. I provide my debit card and ask him to pull up my account. He does. I ask him how much is available for immediate withdrawal. He says approximately $220,000. I tell him it isn’t my money and the bulk of that money is in an account that isn’t mine. We stare at each other for a long time.

- After he gathered his wits about him he starts making phone calls to escalate the matter. After two hours they still have no explanation and are having difficulty removing the well funded account from my login. Apparently the account belongs to a company with the same user name that I have. Which is impossible in their system. The only way they can get the money out of my reach is to destroy my online profile and recreate it with a new user name. I’m led to believe that my account and information has been made accessible to the other company as well.

- He starts to fill out lots of forms. He says “This form has a check box I need to ask you about. Based on what I know about you, I assume you are going to the media. Have you done so already or will you?” I say “No I haven’t and yes I will. In addition, when I leave your office my next phone call is to the owner of this account. I assume if I don’t tell him what happened with his money and information, no one else will. I’m going to tell him his bank balance and ask him if he has a good lawyer. I also want you to include in your notes that I’m demanding an affidavit from Bank of America stating that during the time I was granted access to these funds I didn’t take any.”

- I was given a case number and informed that I would be contacted by a “special internal group” that has “questions” about the screen shots I took to document the matter. I suppose “questions” is another way of saying “demands that I destroy evidence of the bank’s wrong doings”. So far I’ve heard nothing.

- I leave the branch and call the owner of the business whose account I’d been granted access to. Apparently there’s no diplomatic way to start a conversation like this and I’m hung up on twice. The third time I got the owner and blurted out his account balance before he could hang up. Now he’s listening. I explained everything and, long story short, he didn’t seem to be concerned at all about what happened. He has too much faith in the banking system to believe there could be risk.

The Bank of America customer says he wanted to share the story to let people “to determine the quantity and degree of ways Bank of America breached policy, contract, fiduciary responsibility, protection of privacy and the extent to which the software that manages trillions of dollars may be flawed”.

BelleNews.com has contacted both Bank of America and its customer for comments. We will keep you updated.

More info to come soon…