Lenovo has reported a 23% jump in net profit for Q2 2014 as laptop sales outperformed industry average.

For the three months to June, net profit rose to $214 million. Revenue in the same quarter jumped 18% from the previous year to $10.4 billion.

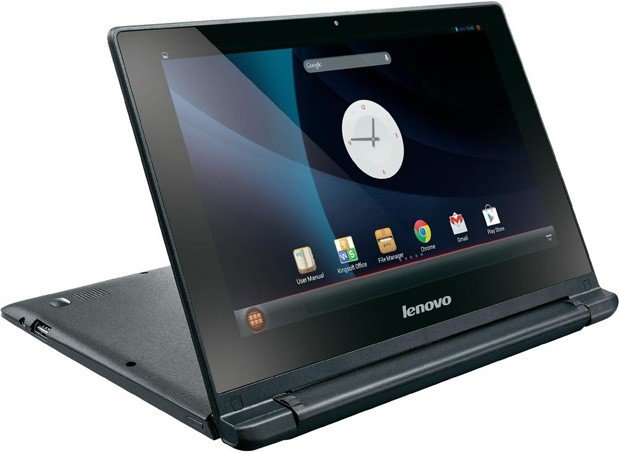

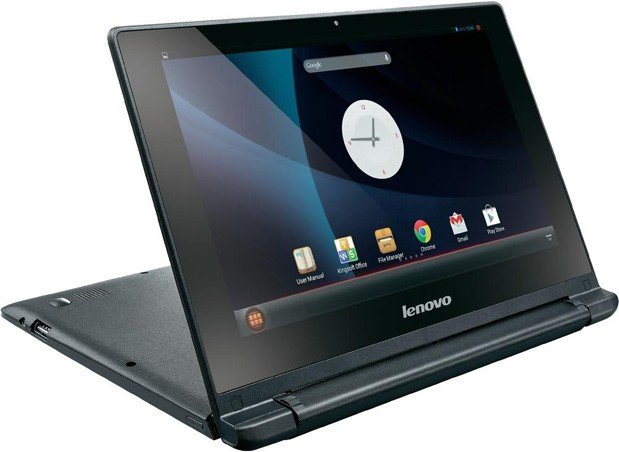

Lenovo’s core business lies in personal computers and accounts for 49% of total revenue in the quarter to June.

Laptop sales rose 12% in that period, when the industry was in a downturn.

The world’s biggest maker of personal computers said the PC industry saw a 3.7% decline in laptop shipments for the three months to June, when compared to the same period last year.

The latest figures indicate Lenovo has maintained its status as market leader for PCs, with a higher global market share of nearly 20% when compared to last year.

In a statement which accompanied the earnings release, Lenovo Chairman Yang Yuanqing said: “This has been a quarter of milestones for Lenovo – record PC share, a number three ranking in worldwide tablets for the first time and an even stronger number four global smartphone position.”

Lenovo has been making moves to diversify away from the shrinking global PC market. Its “Mobile Device Business” includes smartphones and tablets.

For the first time ever, Lenovo said it had sold more smartphones than PCs, with a record volume of 15.8 million units. That is a 39% gain from the previous year.

Yang Yuanqing also said: “As the PC industry recovers, the smartphone market continues its shift from premium to mainstream, and our acquisitions of Motorola Mobility and IBM x86 proceed toward completion, we see even more opportunity to keep growing rapidly.

“Lenovo continues to outperform the market and meet our commitments to improve profitability in our core businesses, while building strong pillars for future growth across our entire portfolio.”

The company has been on an acquisition spree. Earlier this year it struck a deal to acquire IBM’s low-end server unit.

Lenovo is also in the process of acquiring Motorola’s handset business from Google.

Both deals are awaiting regulatory approval, which analysts say could come as early as the third quarter of this year.