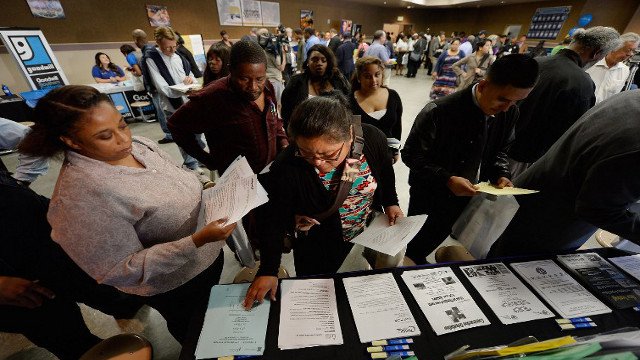

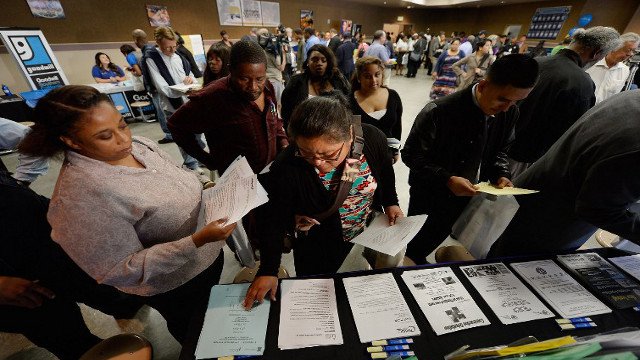

According to US Labor Department figures, the US economy added 175,000 new jobs in February, but the unemployment rate rose slightly to 6.7%.

The jobs figures were better than many had been expecting and marked a rebound from two weak months.

It had been thought the figures would be affected by recent harsh weather, which had hit much of the country.

But the unemployment rate, based on different statistics, went up slightly from January’s 6.6% to 6.7%.

February’s jobs figure – known as non-farm payrolls and based on a survey of employers – compares with the 129,000 new jobs created in January.

Analysts had been expecting a rise of about 150,000 last month.

A large chunk of the gains came from financial and other services, which were responsible for an extra 79,000 jobs.

Construction companies, many of which had been affected by the bad weather, added 15,000 jobs.

But the information sector lost 16,000 jobs, most of them in film and sound recording.

Average hourly earnings in the private sector rose by 3.7%, or about nine cents, to $24.31, the figures show. Over the year, average hourly earnings have risen by 2.2%.

The unemployment rate is calculated from a different survey, of households, and rose slightly from its lowest level since October 2008. It leaves the total number of unemployed relatively unchanged at 10.5 million.

However, the same survey shows the number of long-term unemployed (defined as those jobless for 27 weeks or more) increased by 203,000 in February to 3.8 million.

Cold and snowy weather, which has disrupted much of the country, was one of the reasons 601,000 people with jobs stayed at home last month, according to the survey.

The US Federal Reserve has said the severe winter was to blame for recent weaknesses in jobs numbers, retail sales and housebuilding.

Analysts see the latest figures as further evidence the apparent slowdown was only a blip.

The stronger-than-expected figures are likely to mean the Federal Reserve will continue to withdraw extra support from the economy – a process known as tapering.

The Fed had been spending $85 billion a month buying bonds, but has now reduced that to $65 billion and plans to cut the program by $10 billion each month.

[youtube gdwRXxnoYZ8 650]