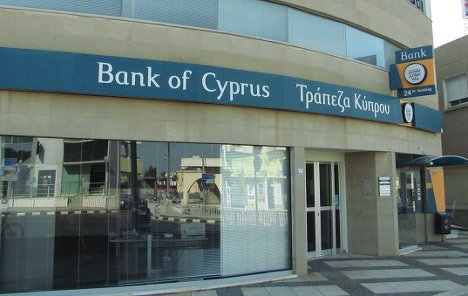

Bank of Cyprus depositors with more than 100,000 euros ($128,200) could lose up to 60% of their savings as part of the EU-IMF bailout restructuring move, officials say.

The central bank of Cyprus said 37.5% of holdings over 100,000 euros would become shares.

Up to 22.5% will go into a fund attracting no interest and may be subject to further write-offs.

The other 40% will attract interest – but this will not be paid unless the bank performs well.

Cypriot officials have also said that big depositors at Laiki – the country’s second largest bank – could face an even tougher “haircut”. However, no details have been released.

The officials say that Laiki will eventually be absorbed into the Bank of Cyprus.

Cyprus needs to raise 5.8 billion euros to qualify for the bailout, and has become the first eurozone member country to bring in capital controls to prevent a torrent of money leaving the island and credit institutions collapsing.

On Thursday, banks in Cyprus opened for the first time in nearly two weeks. Queues formed of people trying to access their money, but the mood was generally calm.

By Friday, banks had returned to their normal working hours and there were no longer reports of big queues.