Fears that other Spanish regions may follow Valencia in seeking a bailout from Madrid have rattled markets.

A local newspaper in Murcia, one of Spain’s smallest regions, quoted the regional government’s head as saying it would ask for funding help of up to 300 million Euros.

On Friday Valencia asked the central government for a financial lifeline.

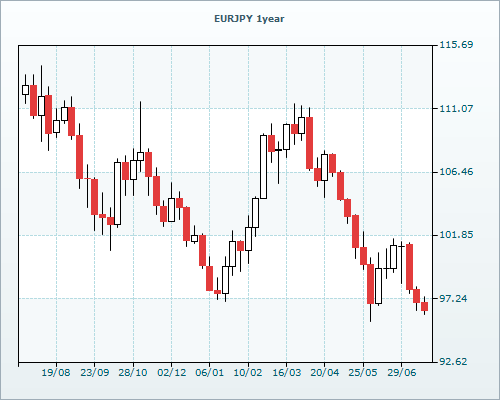

The yield on Spain’s 10-year bond jumped to 7.4%, while the euro fell to an 11-year low against the yen.

On Friday the bond yield – which implies the interest rate the government would have to pay to borrow new money, and acts as a measure of investor confidence in Spain’s creditworthiness – was at 7.28%.

Many of Spain’s regions have high borrowing needs, and speculation is growing that a number of them will follow Valencia and ask formally money from Madrid at a time when the central government itself is having trouble borrowing money.

In Asian trading overnight, the euro fell to an 11-year low against the Japanese yen – which has acted as a safe haven currency since the 2008 financial crisis – amid fears that debt problems in Spain are worsening.

The euro fell to 94.37 yen, its lowest level since November 2000.

Analysts said the developments in Spain had raised fears that the eurozone debt crisis was worsening and spreading to the region’s biggest economies.

Asian stock markets also fell on Monday amid fears that the ongoing debt problems in eurozone will hurt the region’s growth.

Japan’s Nikkei 225 index fell 1.9%, South Korea’s Kospi dropped 1.8% and Australia’s ASX 200 index shed 1.7%.

The eurozone is a key market for Asian exports and there are concerns that demand from the region may decline in the near term.

At the same time, a weaker euro has also added to the woes of Asian exporters, as it makes their goods more expensive for buyers from the region.