Some less-than-enthused analysts are already warning their clients against buying Facebook’s shares one day after the social networking site rolled out its much-anticipated IPO.

Brian Wieser, an analyst at Pivotal Research Group in New York, said that Facebook’s shares were implausibly priced, leading him to put a “sell” rating on the stock.

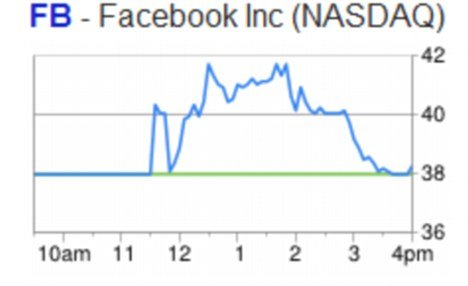

Facebook’s less-than-stellar debut saw its shares end the day on Friday just 23 cents, or 0.6%, higher than its initial price, at $38.23, valuing the company at $104.2 billion – even though it only made $3.7 billion last year.

The shares opened up 11% at a respectable price of $42.05 in the morning, and jumped as high as $45 at one point, only to fizzle out after initial technical difficulties delayed the start of the trading by about two hours.

“While we like the company, we’re troubled by investors’ perception of the risks,” Brian Weiser told the Sunday Telegraph.

“It’s priced for perfection and that’s clearly implausible.”

Company filings after the market closed on Friday night revealed the extent to which the banks who underwrote Facebook’s massive $6 billion IPO were forced to move in and prop up Facebook’s shares to prevent them from nosediving below $38, the New York Post reported.

Morgan Stanley, Facebook’s lead financial adviser, ended the day with 162 million Facebook shares worth $6.16 billion. Other banks, including JP Morgan and Goldman Sachs, ended the day with $3.2 billion and $2.4 billion holdings, respectively.

According to Wall Street experts, without the “bank bailout”, Facebook’s IPO would have been a dud on Friday.

The heavy buying, however, decreased the banks’ already small fees on the deal: the underwriters agreed to accept just 1.1% of the $16 billion Facebook raised in the IPO.

After splitting $176 million in fees, the firms likely spent around $380 million on the shares, wiping out their already-meager profits.

Doing a post-mortem of the disappointing IPO roll-out, many experts put the blame on the bankers for setting the price too high.

The banks were apparently wary of pricing the shares too low, aiming for a modest first-day gain of anywhere between 5% and 10%, which failed to materialize.

Facebook had increased the number of shares being sold in the IPO by 25%, to 425million, with most of the additional float coming from early investors looking to cash out – a move that had raised a red flag among analysts.

It remains to be seen what the future holds for Facebook. The social media giant will be forced to balance the need to feature more advertisements on the site with the risk of alienating its 900 million users, whose loyalty is integral to Facebook’s success.

The fact that Facebook will have to make further acquisitions, and has a still unproven advertising model, are two of the reasons why Pivotal argues Facebook stock should have been priced no higher than $30.

“None of this is to take away from the fantastic success of the company,” said Brian Wieser.

“It’s just not consistent with the economics.”

When trading resumes at New York’s NASDAQ exchange on Monday morning, investors will be watching closely to see how Facebook shares perform in the heels of the lackluster first day.

Meanwhile, the Securities and Exchange Commission, the financial regulator, has said it will review the technical glitches that marred the roll-out of the IPO to determine the cause of the delay.