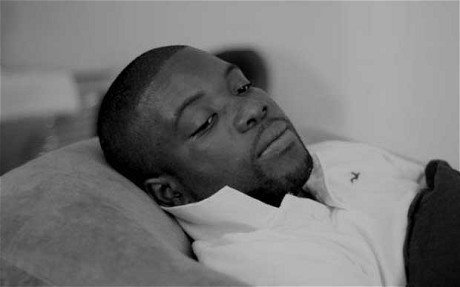

Kweku Adoboli, the trader who allegedly gambled away a record of $2.3 billion, has pleaded not guilty to two charges of false accounting and two of fraud while working for Swiss bank UBS at Southwark Crown Court today.

Kweku Adoboli, 31, of Clark Street, east London, appeared at Southwark Crown Court accused of unauthorized trading that lost UBS about $2.3 billion.

The alleged rogue trader worked for UBS’s global synthetic equities division, buying and selling exchange traded funds, which track different types of stocks, bonds or commodities such as metals.

Kweku Adoboli is accused of dishonestly using his position to try to make a personal gain, and causing UBS losses or exposing the bank to the risk of loss.

City watchdog the Financial Services Authority and its Swiss counterpart have launched an investigation into why UBS failed to spot allegedly fraudulent trading.

Kweku Adoboli, the son of a former Ghanaian official to the United Nations, joined the bank in a junior capacity in 2002.

Charges relate to the period between October 2008 and September last year.

Prosecutors allege he gambled away the cash while buying and selling exchange traded funds.

Judge Alistair McCreath granted Kweku Adoboli’s new defense team an extra month to consult with their client after a previous appearance.

Kweku Adoboli switched legal teams in November.

He has hired London law firm Bark & Co, which specializes in fraud cases, in place of Kingsley Napley.

Judge Alistair McCreath set a provisional trial date of 3 September.

The judge remanded Kweku Adoboli in custody. A pre-trial management hearing will take place on 9 April.

[youtube 2BDOu8EdEiI]